Introducing Nomial: An Open Liquidity Network for the Modular Ecosystem

Nomial unlocks an opportunity for anyone holding tokens on rollups to participate in cross-chain intent settlement and earn yield

tl;dr:

Nomial is the first Open Liquidity Network for the modular ecosystem.

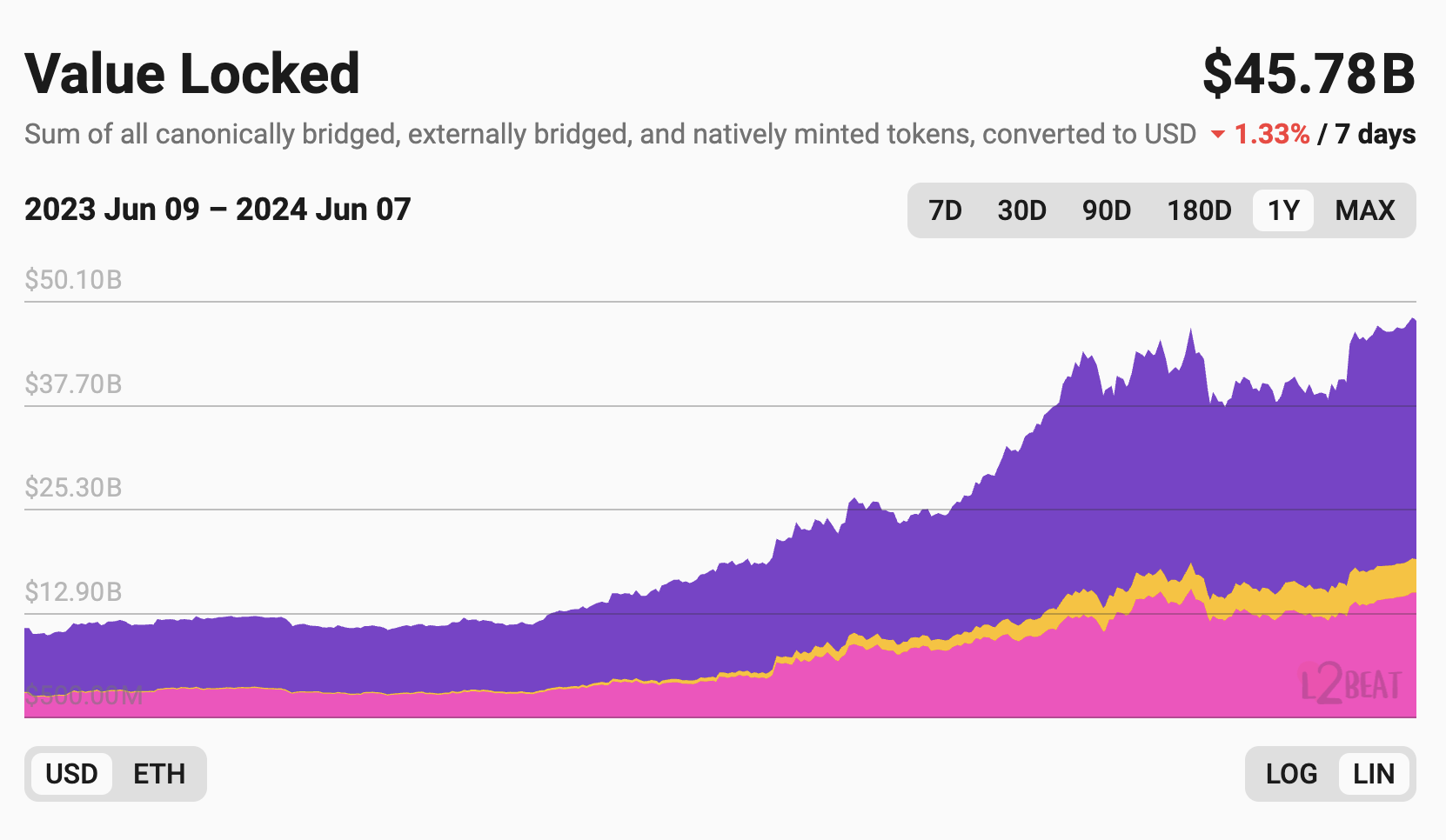

Intents are emerging as the leading architecture for bridging assets in an exponentially growing ecosystem of L2’s, but the opportunity to profit from intent settlement is largely centralized to a small group of advanced fillers. At this time, there are hundreds of millions of addresses holding $50B of TVL in L2’s, but only a tiny fraction of this capital is actively used to fill intents.

We are creating Nomial to solve the Intent Centralization Problem. Nomial unlocks an opportunity for anyone who holds tokens on L2’s to passively provide liquidity for intent settlement and earn yield.

The Intent Centralization Problem

There are only a handful of fillers servicing billions of dollars of cross-chain intent order-flow. These fillers support less than 1% of deployed rollups, and are not in a position to scale to support the rapidly expanding modular ecosystem due to challenges around liquidity rebalancing and settlement.

Intents protocols rely on open networks of Fillers to service all bridging volume. Fillers hold and rebalance their asset inventory across L2’s and compete to settle user intents instantly and earn profit.

Anyone can run a filler, but in practice nearly 100% of fillers are operated by the intents protocols themselves.

There are hundreds of millions of addresses holding nearly $50B on L2’s, but earning profit as an intent filler is prohibitively complex for the majority of L2 asset holders. It involves building and running off-chain infrastructure, participating in order flow auctions (OFA’s), fronting enough capital to fill swaps often exceeding many thousands of dollars, and sometimes convincing certain intents protocols to add them to allowlists.

For the owners of most of the addresses contributing to this TVL, the level of effort required to earn yield from intent settlement is too high to participate.

An Open Liquidity Network

We are proposing a new construct, an Open Liquidity Network, that unlocks the opportunity for anyone holding tokens on L2’s to earn yield from intent settlement by simply depositing a position.

An Open Liquidity Network decouples the roles of liquidity providers and fillers. Users with assets on any rollup can participate in the intent settlement process as liquidity providers through passively held, yield-bearing positions. Fillers who participate as sophisticated relay agents can leverage these positions for instant settlement without taking on the risky challenge of managing fragmented inventory across multiple chains.

The Open Liquidity Network is a network of cross-chain liquidity pools that can be utilized by fillers to settle swaps from intent protocols. Today, modular blockchains rely on concentrated, filler provided liquidity to support intents protocols. In the future, they can rely on open liquidity provided by anyone.

Features of an Open Liquidity Network

- Anyone can create and contribute to Liquidity Pools. Contributing to a pool should be simple for passive asset holders to earn yield.

- Fillers use Liquidity Pools instead of managing capital. Capital in the network is openly available for fillers to use instantly to settle intents now and repay later. Fillers are kept in check through an optimistic challenge mechanism and severe slashing penalties for failed repayment.

- Integrates new and existing rollups without any special infrastructure. Adding a new rollup to the network can be done entirely at the protocol level, without requiring any rollup-specific off chain infrastructure to be set up.

- Supports existing protocols and standards. Open Liquidity Networks should support the ERC-7683 Standard for Cross Chain Intents, enabling compatibility with intents protocols such as UniswapX and Across.

Benefits to the Modular Ecosystem

An Open Liquidity Network benefits many actors in the ecosystem such as:

- User Interfaces/Aggregators/Order Flow Originators: this includes swap interfaces and bridges such as SquidRouter, Li.Fi, Socket, Uniswap, Metamask, and many more. Deeper liquidity for more asset pairs and chains results in better prices for users of any interface offering bridge/swap functionality.

- Intents Protocols: protocols such as UniswapX and Across rely on filler/solver participation and competition. Because of the high cost of entry, participation is limited, leading to limited route and chain support that is primarily bootstrapped by the protocols themselves. Passive liquidity generated through an Open Liquidity Network reduces barriers for new routes and new chains.

- L2’s: permissionless pools for cross-chain intents make it easier to acquire TVL from base layer chains and other L2’s. There are no permission or capital requirements to integrate a new or existing L2 with an Open Liquidity Network. Rollup communities can even bootstrap markets for newly issued tokens directly with base layer chains or major assets on other L2’s, without the need to set up any infrastructure.

- RaaS Providers: Open Liquidity Network Pools for newly deployed rollups gives them the ability to bootstrap markets for intent settlement entirely through smart contract primitives, without setting up any special filler infrastructure.

- Existing Fillers/Solvers: Fillers and solver networks are currently limited by the cost of asset fragmentation across chains, rebalancing, and fronting capital for instant cross-chain settlement. An Open Liquidity Network provides a source of capital for instant intent settlement.

Nomial: The First Open Liquidity Network

Nomial is designed for average users holding tokens on L2’s to participate in the intent settlement process as Liquidity Providers (LP’s). Nomial opens up the first opportunity to earn yield for filling intents through a passive position.

Opportunity for L2 Token Holders

When L2 token holders contribute as LP’s to a Nomial Pool, their capital is available to help fillers settle user intents instantly. Fillers are actively operating off-chain relayers that compete to earn profit. Fillers pay fees to use capital from Nomial Pools, and the fees that accrue in the pools go to LP’s.

Network Roles

- Liquidity Providers: Provide liquidity to pools. Any user with assets on a rollup can become a Liquidity Provider by creating a position on a Nomial Pool.

- Fillers / Solvers: Settle intents for bridges and intent protocols by running off-chain infrastructure to compete and win order flow auctions (OFA’s).

- Swappers: Interact with intent protocols to swap assets between chains.

- Note: “Swap” in this context can mean either a like-kind swap of an asset between chains (e.g., moving ETH on one chain to ETH on another chain) or swapping one asset to a different asset on another chain (e.g., trading DAI on one chain for ETH on another chain)

Intents Stack

Users typically interact with intents through UI’s. User intents are settled through protocols that auction them to Fillers via Order Flow Auctions (OFA’s). Nomial exists to provide deeper liquidity and more asset and chain route coverage for all entities interacting with the stack, including end-users.

- Order Flow Originators (OFO’s): Any interface where users submit intents. These are typically swap UI’s, cross-chain bridging aggregators, and wallets. Intents created by users through OFO’s are sent to Intent Protocols.

- Intent Protocols: The protocols that auction intents to Fillers (aka Solvers) through Order Flow Auctions (OFA’s). Typically they are referred to as intent-based bridges or cross-chain swap protocols.

- Fillers / Solvers: The entities that bid in OFA’s and compete to settle intents. They typically use PMM (Private Market Maker) pools that they own and manage in order to maximize efficiency, but private capital becomes fragmented and expensive to manage across hundreds or thousands of rollups.

- Open Liquidity Network: Nomial exists to provide an Open Liquidity Network for LP’s (Liquidity Providers) to contribute to and for Fillers to use in place of fragmented PMM pools.

Design Principles

- Simple LP Participation: Participating as a Liquidity Provider (LP) should be simple. LP’s only have to choose a pool and express their desired price range and deposit amounts. Pools have common parameters for price, fee, and filler bond requirements.

- Compatibility with existing intent-based bridges: The Nomial Network itself is not a bridge, but it does provide a critical service for intents-based bridges by providing an accessible source of capital for intent fillers.

- Fillers can instantly access output and repay input later: This is critical for the Nomial Network to support existing intent protocols and standards such as the ERC-7683 Standard for Cross Chain Intents. Intent protocols require the filler to send the user’s output asset instantly and force the filler to wait to claim the user’s input asset.

- Pools support cross-chain asset markets: Nomial Pools function as open liquidity between two assets that exist on different blockchain networks. Conceptually these are similar to single-chain markets such as Uniswap AMM pools, but unlike single-chain markets they support non-atomic swaps.

- Fillers provide a single-asset bond on a single network: In place of managing capital across thousands of blockchains, Fillers instead provide a bond in ETH on the Nomial Rollup. Their single-asset bond gives them access to capital in Nomial Pools, and ensures that fillers repay what they owe.

- Optimistic settlement mechanism enforces pool repayment: Fillers are responsible for repaying Nomial Pools what they owe. Challengers can force bond liquidation for delinquent fillers. Liquidations result in pooled capital being converted to ETH for a large liquidation fee that will be paid to LP’s.

- Pool rebalancing is driven by an open market: Whether a pool’s assets are like kind (ETH-ETH or USDC-DAI) or more volatile (ETH-DAI), they exist on a price curve and their ratio is kept in balance by market arbitragers. Pools do not use a 1:1 lock and mint design which would require explicit rebalancing.

Settlement Process

Nomial Pools provide liquidity for intent settlement. Intents are initiated by swappers interacting with an Intent Protocol. Their intents are auctioned to fillers, and the winning filler is responsible for sourcing liquidity for settlement.

This diagram shows the preconditions and steps involved in the intent settlement process for a cross-chain swap.

Preconditions

- Liquidity Providers: LP’s deposit assets to Nomial Pools

- Filler Bonds: Fillers post bonds on the Nomial Rollup

Steps

- Submit Intent: The intent is submitted to an Intent Protocol such as UniswapX

- Claim Order: The filler claims the order in an Intent Protocol

- Pull input asset: The Input Asset (the asset the Swapper is giving up) gets pulled from the Swapper and deposited into a Claim Contract.

- Filler borrows Output Asset: The Filler borrows from a Nomial Pool on the Output Chain

- Filler provides Output Asset to Swapper: The Filler passes along the Output Asset to the Swapper.

- Release Input Asset to Filler: After a period of time determined by the Intent Protocol, the Filler can claim the Input Asset from the Claim Contract.

- Filler repays Input Asset to Input Pool: The Filler repays the Input Asset to the Input Pool

This shows the optimistic case, where the Filler fully repays the Input Asset pool. If the Filler fails to pay what they owe or does not pay a sufficient amount, a challenge can be issued to slash the Filler’s bond, which will be used to repay the pool what is owed plus an additional liquidation fee.

Summary

Nomial’s Open Liquidity Network provides the first opportunity for token holders on rollups to earn yield from intent settlement, helps Fillers scale to support more liquidity on more chains, and scales to support the future of modular blockchains.

Stay Connected

We are excited to share more details as we roll out Nomial. Keep up to date by following us on: